Based on coverage from CBC, Global, and the Financial Post.

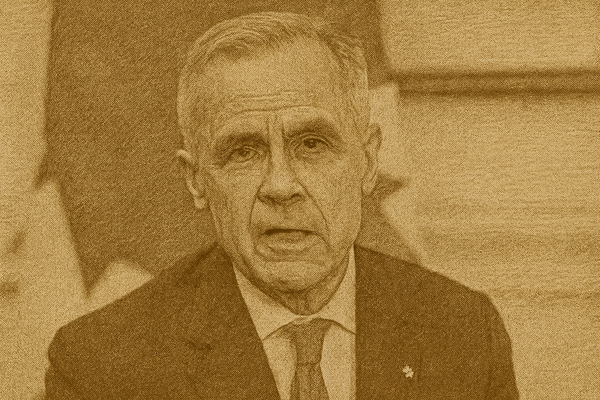

The Canadian political landscape is abuzz with anticipation as the Liberal government gears up to unveil its federal budget on November 4. This budget, the first under Prime Minister Mark Carney, is being touted as a "generational investment" in Canada's future, according to Finance Minister François-Philippe Champagne. But with great investment comes great responsibility—and, it seems, a significant deficit.

The timing of the budget has already stirred some debate. Initially slated for October, the announcement was pushed back, a decision that has drawn criticism from Conservative Leader Pierre Poilievre. He accused the Liberals of reckless spending and delaying the budget unnecessarily. Despite the political jabs, Poilievre has not ruled out supporting the budget, indicating he’ll wait to see the numbers before making a decision.

The budget is expected to feature substantial spending plans aimed at strengthening Canada's economy in the long term. However, this comes with the caveat of an increased deficit in the short term. Carney has hinted that the deficit could surpass last year’s $48 billion shortfall, with some economists predicting it could reach as high as $70 billion. The government attributes this to several factors, including U.S. tariffs, increased NATO commitments, and a federal income tax cut.

Finance Minister Champagne has been vocal about the need for "tough choices" to manage the budget effectively. He has emphasized the importance of distinguishing between operational expenses and capital investments. The government plans to cut operational spending by up to 15% by 2028-29, while boosting capital investments to build a more resilient economy. This approach, Champagne argues, will allow Canada to invest ambitiously in its future while being rigorous in its current expenditures.

The budget's implications extend beyond fiscal policy. Economists suggest it could influence the Bank of Canada's interest rate decisions. With the Bank recently cutting its policy rate to 2.5%, there's speculation about whether further cuts will follow. Some experts believe the Bank will hold off on additional cuts until the budget's details are clear, as the fiscal stimulus could impact economic forecasts.

The stakes are high for the Liberals, who will need the support of at least one other party in the minority Parliament to pass the budget. As budgets are confidence votes, failure to pass could lead to the government's collapse. This adds an extra layer of complexity to an already intricate fiscal puzzle.

In the backdrop of these financial maneuvers is a broader narrative of economic transformation. Champagne has drawn parallels to post-World War II Canada, envisioning a similar reinvention through investments in technology and industry. This vision aims to position Canada as a leader in the 21st-century global economy, but it requires navigating the choppy waters of current economic challenges.

As November 4 approaches, Canadians are left to ponder the balance between immediate fiscal responsibility and long-term economic growth. The budget's unveiling will not only set the tone for the country's financial future but also test the government's ability to deliver on its promises amid political and economic scrutiny. Whether this "generational investment" will indeed pave the way for a stronger Canada remains to be seen, but one thing is certain: the coming weeks will be pivotal in shaping the nation's economic trajectory.