Based on coverage from CBC and Mining.com.

Canada is taking a significant step in bolstering its critical minerals sector, designating these resources as a national security priority under the Defence Production Act. This move, announced at a G7 energy and environment meeting in Toronto, aims to counter China's dominance in the critical minerals market by ensuring Canadian mining projects have guaranteed buyers and minimum prices. These minerals are essential for modern technologies, including electric vehicles and clean energy solutions.

Canada Invests in Critical Minerals Projects

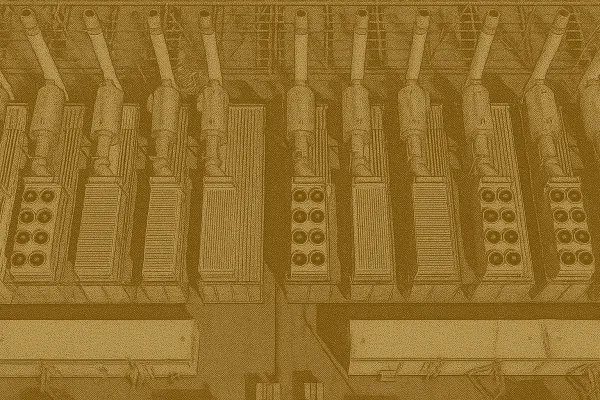

At the G7 meeting, Energy Minister Tim Hodgson revealed that G7 countries are investing $6.4 billion into 26 critical mineral projects across Canada. This investment is part of a broader strategy to reduce reliance on Chinese minerals. Notable projects receiving funding include Nouveau Monde Graphite’s Matawinie mine near Montreal, Rio Tinto’s Scandium production plant in Sorel-Tracy, Quebec, and Torngat Metals’ Strange Lake project, also in Quebec. The government has kept the price floor for these minerals confidential for security and commercial reasons.

The initiative is designed to provide Canadian companies with the support they need to compete against Chinese suppliers. Without such intervention, Canadian projects often struggle to secure financing due to the risk of being undercut by China, which dominates the market for many critical minerals. Pierre Gratton, president of the Mining Association of Canada, highlighted the vulnerability of Canadian projects to sudden price drops orchestrated by Chinese competitors.

Support The Canada Report and help keep it ad-free and independent — click here before you shop online . We may receive a small commission if you make a purchase. Your support means a lot — thank you.

G7 Alliance to Strengthen Mineral Supply Chains

Hodgson has been engaging with G7 counterparts to form a critical minerals production alliance, or a "buyers club," to support projects within the bloc. This alliance aims to establish price floors and long-term buying agreements, strengthening Western countries' production capabilities. China currently refines 19 out of 20 important strategic minerals, holding an average market share of 70%, according to the International Energy Agency. This dominance has grown alongside the increasing global demand for these minerals, driven by the rise of technologies like battery-electric vehicles and solar panels.

Canada's untapped resources present a multi-billion dollar opportunity, according to Eyab Al-Aini of the Canadian Climate Institute. His analysis indicates that domestic demand for critical minerals could reach $16 billion annually by 2040, largely due to the burgeoning local battery production industry. Al-Aini emphasized that as global energy investments shift towards clean technologies, the demand for critical minerals will only increase.

Strategic Moves to Secure Canada's Mineral Future

The Canadian government, led by Prime Minister Mark Carney, announced 25 new investments and partnerships totaling C$1.4 billion at the G7 meeting. These measures are part of a G7 initiative to bolster investments in raw materials crucial for defense, clean energy, and advanced manufacturing. The deals aim to secure supplies outside of China, focusing on metals like copper, lithium, nickel, and rare earth elements.

Among the projects, Rio Tinto's Quebec plant will produce scandium, a metal used in aerospace and defense manufacturing. Ucore Rare Metals Inc. received conditional funding to expand its rare earths processing plant in Ontario. Other beneficiaries include Northern Graphite Corp., Focus Graphite Inc., and Torngat Metals Ltd. Notably, Nouveau Monde Graphite saw a significant stock market boost following the announcement of a future supply deal with Canada, Panasonic Holdings Corp., and Traxys North America LLC.

Canada's designation of critical minerals as essential to national defense allows for stockpiling and supports multilateral caching efforts. Hodgson stated that these measures will enhance Canada's strategic capabilities and contribute to NATO and defense spending commitments. By protecting domestic production under volatile global conditions, Canada aims to ensure a secure supply of critical minerals for its defense and allied industries.

Related: Prime Minister Carney Holds First Canada-China Leader Meeting Since 2017 at APEC Summit