Based on coverage from Bloomberg, The Globe and Mail, The Star, and Financial Post.

Bombardier just landed one of its bigger business-jet wins in a while: Dubai-based Vista Global has agreed to buy 40 Challenger 3500 aircraft, a deal Bombardier values at about US$1.18 billion to US$1.2 billion at list prices.

For a Canadian manufacturer that’s spent the last few years climbing out of a tougher stretch, it’s another sign that private aviation demand is still running hot, even as the broader economy throws mixed signals.

Bombardier Challenger 3500 order details

Vista’s agreement covers 40 firm orders of the Challenger 3500, Bombardier’s super-midsize business jet that entered service in 2022 and can seat up to 10 passengers. One of its headline capabilities is range: the aircraft can fly nonstop from New York to London.

On pricing, the numbers vary slightly by source: one report pegs the deal at “about” $1.2 billion at list price, while Bombardier’s own announcement and another report put it at US$1.18 billion based on 2026 list prices. Either way, list prices are a starting point, and large customers often negotiate discounts, especially on bulk orders.

Vista said deliveries will roll out over the next decade.

Vista Global expansion and 120 plane options

The bigger long-term story may be the options attached to the deal. Vista has purchase options for another 120 aircraft. Bombardier says that if all options are exercised, the total would reach 160 planes valued around US$4.72 billion.

Vista, founded more than two decades ago by Thomas Flohr and headquartered in Dubai, sells private flying through subscription and membership models as an alternative to owning a jet outright. The company says its core regions are the U.S. and Europe, so this order is aimed squarely at serving that customer base.

Flohr framed the move as a long view on fleet planning, saying Vista is “building the fleet” members will rely on “over the next decade,” rather than reacting to short-term cycles.

Private jet demand lifts Canadian aerospace

Bombardier’s announcement comes as business jet makers benefit from sustained demand for private flying, swelling order books across the sector.

Bombardier has also been stacking up major commitments. Last year, it announced a large order from Bond Aviation Holdings LLC, a private jet company backed by KKR, agreeing to buy 50 aircraft in a deal valued at $1.7 billion. That agreement also included a services component and an option for an additional 70 planes, which would push the potential value to more than $4 billion if fully exercised.

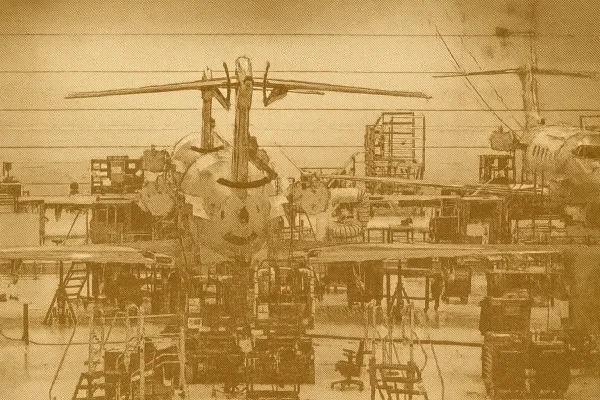

Bombardier has signalled it’s trying to meet this moment. The Montreal-based company announced an expansion of manufacturing facilities near Montreal to increase production capacity, and another report says it’s considering raising production of private jets as demand grows.

U.S. certification dispute and tariff threats ease

The Vista order also lands during what looks like a cooling-off period in a tense Canada-U.S. aviation dispute.

U.S. President Donald Trump had threatened to impose a 50% tariff on Canadian aircraft sold in the U.S. and to strip safety permits from new planes made in Canada, directly targeting Bombardier. The flashpoint was frustration over Canada’s slower certification of jets made by Gulfstream, a General Dynamics unit.

This week, that pressure appeared to ease when Bryan Bedford, head of the U.S. Federal Aviation Administration, said he expects Canada’s aviation regulator to approve Gulfstream jets soon. Transport Canada responded that it continues working with the manufacturer and the FAA, and the shift in tone is likely welcome news for Bombardier and its suppliers.

What Canadians should watch next

Two things matter most from here: whether Vista converts any of those 120 options into firm orders, and whether Bombardier can ramp production fast enough without creating delays.

For Canadians, the near-term impact is less about cheaper flights and more about industrial momentum: strong order flow, expanded production near Montreal, and fewer cross-border regulatory fireworks would all help steady one of Canada’s best-known aerospace manufacturers as it pushes to grow again.

Support Independent Canadian News Analysis

The Canada Report is supported by readers like you. If this article helped you understand what’s happening, you can support our work with a one-time tip.

Support The Canada Report