Based on coverage from CTV and RBC.

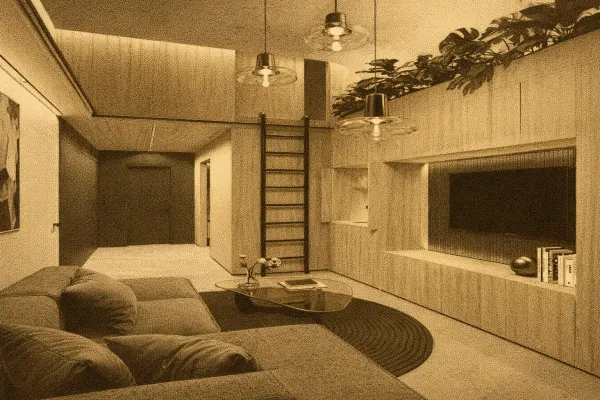

Canada's housing market is a bit like a roller coaster these days—full of ups and downs, and not everyone is enjoying the ride. As the federal government prepares to launch a new agency aimed at speeding up home construction, internal documents paint a grim picture of the current housing landscape. With the cost of building homes up 58% since 2020, the situation is particularly tough for newcomers and vulnerable Canadians who are finding it increasingly difficult to secure affordable housing.

The proposed Build Canada Homes agency is part of a broader strategy to address these challenges. Prime Minister Mark Carney recently announced at a Liberal caucus retreat that the agency would be launched soon. The goal? To ramp up the pace of affordable homebuilding and encourage the adoption of new technologies in construction. But as promising as this sounds, it's a tall order given the current economic climate.

Meanwhile, Canada's housing markets are showing signs of life, albeit unevenly. In August, several cities, including Vancouver, Calgary, Edmonton, and Montreal, saw an uptick in home sales. However, the activity hasn't quite reached the levels seen a year ago, especially in Calgary and Edmonton. Toronto, on the other hand, experienced a slight pause in its recovery, with home resales dipping by 1.8% from July. Still, there’s hope that this is just a temporary blip, with factors like earlier interest rate cuts and easing trade tensions expected to boost transactions.

The regional disparities in housing trends are striking. In the Prairies, Quebec, and parts of Atlantic Canada, balanced conditions are driving property values up. But in Ontario and British Columbia, high inventory levels are keeping prices down. For instance, Toronto's MLS Home Price Index fell by 0.1% from July, extending a year-long downtrend. Condos took the biggest hit, with prices dropping 7% from a year ago.

Montreal is seeing a different story unfold. The city has experienced a flurry of activity, with new listings and home resales jumping by over 8% and 5%, respectively, from July. However, tight supply and steady price increases are making it challenging for budget-constrained buyers. The median prices for single-family homes and condos rose by 7.3% and 3.7%, respectively, from a year ago.

Vancouver is also on the mend, with home resales rising nearly 6% from July. The easing of trade tensions and a surge in active listings have drawn buyers back into the market. Yet, affordability remains a significant hurdle, with the MLS HPI falling 3.8% from a year ago.

Calgary presents a mixed bag. While transactions have picked up, marking a turning point after nearly two years of decline, prices remain under pressure due to increased supply. The MLS HPI was down 4.1% in August from a year ago. With housing construction still at record highs, any potential for price increases seems limited in the short term.

So, what's the takeaway? Canada's housing market is in a state of flux, with regional variations adding layers of complexity. The federal government's efforts to boost affordable housing are a step in the right direction, but the road ahead is fraught with challenges. As the market slowly recovers, affordability remains a pressing issue that will require more than just new agencies and policies to resolve. It's a delicate balancing act, and one that will be closely watched by Canadians from coast to coast.