Based on coverage from The Globe and Mail, Toronto Sun, and Castanet.

Canadians' Debt Sentiment Shows Unexpected Improvement

Canadians are feeling slightly more optimistic about their debt situation, according to the latest MNP Consumer Debt Index. The index, which measures Canadians' attitudes towards their debt and ability to manage expenses, saw a modest increase of one point to 87 in December. This marks the first time since the index's inception in 2017 that it has improved during this period, defying the usual trend of declining sentiment. This comes despite widespread concerns about the economy and rising living costs.

Generational Divide in Financial Outlook

While the overall index showed improvement, a closer look reveals a generational divide. Many younger Canadians, particularly those aged 18 to 34, are struggling with higher debt burdens from student and car loans. About 23 per cent of this age group reported feeling financially paralyzed, and 22 per cent avoided discussing financial matters altogether. In contrast, nearly 60 per cent of Canadians are actively addressing their debt by budgeting and consolidating loans.

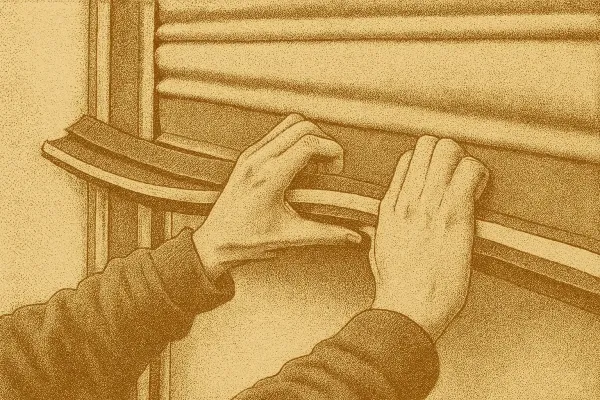

Rising Costs and Mortgage Concerns

The survey highlighted ongoing concerns about the cost of living, with 71 per cent of Canadians expecting it to worsen by 2026. Housing affordability remains a significant issue, as millions of mortgages are up for renewal this year. Falling home values, especially in Ontario, have left some homeowners with little to no equity. Ron Butler of Butler Mortgage noted that lenders are hesitant to renew mortgages for homes purchased at peak prices that have since depreciated.

Persistent Anxiety Over Interest Rates

Interest rates continue to be a major source of stress for Canadians. Although the Bank of Canada held its policy interest rate at 2.25 per cent, 64 per cent of survey respondents expressed an urgent need for rates to decrease. Rising mortgage balances have contributed to a total consumer debt of $2.6 trillion, according to TransUnion's Credit Industry Insights Report. The average new mortgage loan amount increased by 4.1 per cent year over year to $359,623.

Canadians' Financial Resilience Tested

Despite the slight improvement in debt sentiment, Canadians are still facing financial challenges. More than 40 per cent of respondents reported being within $200 of not being able to pay their bills each month, although this is the lowest level recorded in the post-pandemic period. The average amount left after monthly expenses rose by $163 to $907. However, many households are relying on credit to maintain normalcy, rather than for discretionary spending.

Looking Ahead: Economic Uncertainty Looms

As Canadians brace for potential economic challenges, the MNP report underscores the precarious financial situation many face. Rising costs for housing, groceries, and insurance leave little room for error. Francisco Remolino, a licensed insolvency trustee, noted that while some Canadians are managing to keep up with expenses, they are often just one unexpected cost away from insolvency. The coming months will test Canadians' financial resilience as they navigate these uncertain times.