Based on coverage from CBC, Global, VictoriaNews, and AM1150.

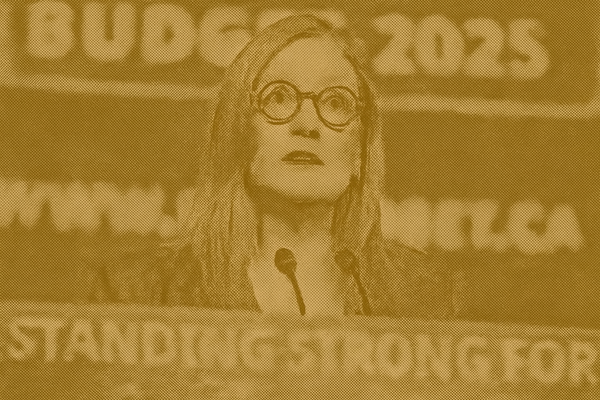

British Columbia's financial forecast is looking a bit stormy these days. The province is staring down the barrel of a record $11.6 billion deficit for the current fiscal year, a figure that’s $665 million higher than what was initially projected in March. Finance Minister Brenda Bailey laid out the details in a recent financial update, painting a picture of a province grappling with a mix of economic challenges and policy decisions that have thrown a wrench in the works.

One of the biggest contributors to this ballooning deficit is the elimination of the provincial carbon tax, which alone has left a $2.8 billion hole in the budget. This decision was made in tandem with Ottawa’s removal of the federal carbon levy, a move Bailey defends as an “affordability measure” rather than a fiscal one. However, the timing of these decisions didn’t align with the province’s budgeting timelines, leaving B.C. to scramble in adjusting its financial plans.

The province is also feeling the pinch from a cooling housing market, which has led to a $247 million drop in property transfer tax revenue. While this is good news for first-time home buyers, it’s less so for the provincial coffers. Add to this the lower-than-expected revenues from natural resources like natural gas and coal, and it’s clear why the financial outlook has taken a hit.

On the flip side, B.C. has seen a revenue bump from its share of a $32.5 billion lawsuit settlement against tobacco companies. The province is set to receive $2.7 billion over the next 18 years, with $936 million already in the bank. While this might sound like a windfall, critics argue that counting future payments in this year's budget is a bit like counting chickens before they hatch. Bailey insists this is standard accounting practice, but B.C. Conservative Finance critic Peter Milobar isn’t buying it, accusing the government of trying to make the financial picture look rosier than it is.

The deficit isn’t the only number on the rise. The province’s total debt is projected to hit $155 billion by the end of this year, with forecasts showing it could climb to nearly $213 billion by 2027-28. Bailey acknowledges this is “very, very concerning” and emphasizes the need for revenue development and careful spending reviews.

In response to these financial pressures, the province is implementing a hiring freeze and reducing the size of the public service by 850 positions, mostly through attrition. This move is part of a broader effort to cut $1.5 billion in government expenses over the next three years. However, with public sector unions like the B.C. General Employees’ Union already taking job action, the government’s cost-cutting measures could face significant pushback.

The financial update comes amidst a backdrop of global economic uncertainty, with tariffs and a slowing global economy adding to the province’s woes. Despite these challenges, Bailey remains optimistic, highlighting B.C.’s diversified economy as a buffer against these headwinds. She points to potential growth areas like liquefied natural gas exports and residential construction as bright spots on the horizon.

Still, the road ahead is fraught with challenges. The government’s ability to navigate these fiscal headwinds will be critical in determining whether it can maintain the services British Columbians rely on while steering the province back to financial stability. As the province braces for a potentially tougher economic climate, all eyes will be on how these strategies play out in the coming months and years.